Car Insurance Quotes Texas Online – Just call to book a quote – your email and proof of cover is sent to you instantly.

It only takes 90 seconds. It is a simple, easy and online application to get the best deals.

Car Insurance Quotes Texas Online

I’ve had the mask for over a year and I have to say I’ve never been happier. Their service is excellent and they always go above and beyond to help me and answer any questions I have. They explain in an easy to understand way and I really appreciate it! Thank you very much!

The Best Car Insurance In Texas For 2023

What a nice place. Who doesn’t love a free quote? The staff is very friendly. Suite can be difficult to find some, but they make it quick and painless.

The staff was always friendly and willing to go out of their way to make sure my insurance needs were met. I appreciate their relationships and their willingness to make their customers their number one priority.

It uses intelligence to give you personalized monthly tips and reminders for your goals and priorities.

It also gives you an online digital journal where you can securely store photos, receipts and other records.Coverage Cat found Acuity to have the best affordable car insurance with an average premium of about $36 per month. The average Texan pays $87 a month for auto insurance, or $1,044 a year, while the average Texan with an Acuity policy pays just $432 a year, saving them about $612 a year.

The Ultimate Guide To Saving On Car Insurance

While it can be tempting to go with the “cheapest” carrier for your insurance, what you pay for car insurance naturally depends on thousands of factors, from your postcode to your age to the type of insurance you buy and the car. you drive.

That being said, one of the worst parts about buying car insurance is that it’s almost impossible to find out how much it costs without getting a quote.

At Insurance, we use data collected from millions of auto insurance companies to keep you on track.

Get compensation from small businesses. Whether you drive a Ford F-150 or a Toyota Camry, small companies like Mercury, Clearcover and Elephant offer Texans the best insurance rates. Acuity, Gainsco and Dairyland are also good choices for low cost auto insurance in Texas.

Get Cheap Car Insurance Online — Instant Quotes

If you’d rather skip filing a claim with any of these companies, get a quote from us – we’ll find the best insurance policy for multiple insurance companies. We’re hassle free, no calling, minimal emailing – we can save you time (and often money).

We’ve compiled the data and written this guide to help those who want to make smart financial choices with real data and solid advice (not conventional wisdom).

Finding the best deal on Texas auto insurance isn’t easy because prices and eligibility can vary from person to person, and insurers don’t show you price differences.

To find out how we receive our advice, please read: our process, why you should trust us and editorial notes.

Fl Online Auto Insurance Quotes

Warning: This data, which reflects insurance references provided to other drivers, may or may not apply to you. The data presented here is intended to give you a general estimate of what you can afford and not a quote.

I’m Max Cho, a licensed insurance agent and founder/CEO of Insurance. I started looking around for a case and actually learned how to use it and bought it over 15 years ago when an accident caused me to lose two teeth. This experience inspired me to start Insurance as a way for people to find clear pricing data about their insurance and use that information to make better choices. I want to help all Americans avoid paying for expensive insurance they don’t need and get the right insurance at the right price.

Before starting insurance and becoming a licensed insurance agent, I spent the last ten years working in quantitative accounting at Google, Two Sigma and Microsoft.

For this guide, we’ve built a unique database of tens of thousands of auto insurance policies pulled from public data. When you test our insurance quote system, we use this data set and others to recommend the best insurance agents for their needs.

Temporary Car Insurance In Texas

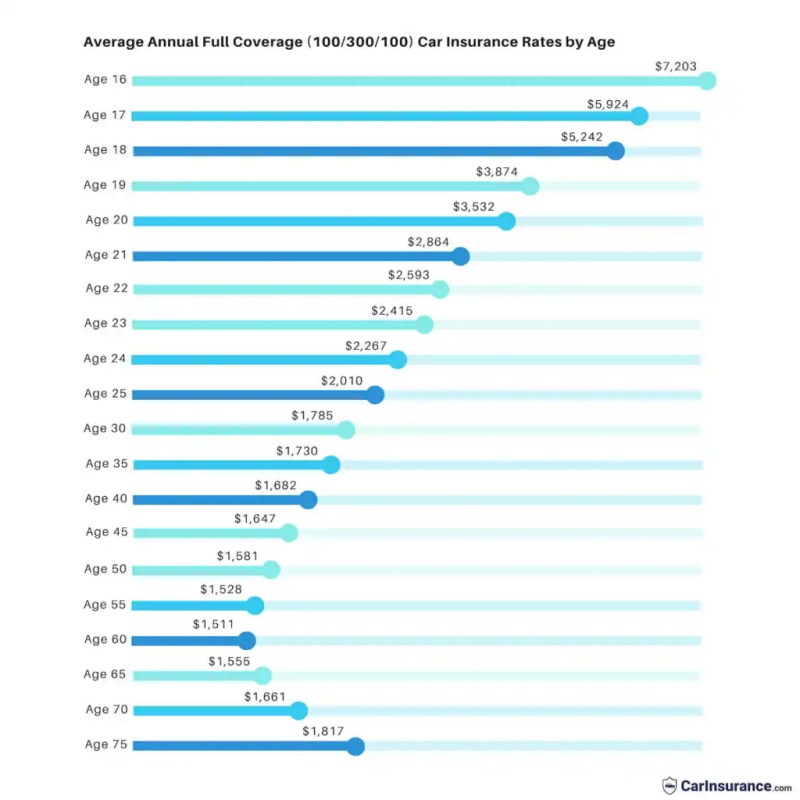

To learn more about our selection, over 76,000 auto insurance quotes for Texas drivers. In this data set, we represented drivers aged 16 to 70, driving for up to 15 years and from different models.

Using thousands of comments, we will be able to better understand the data and apply data visualization to provide a random Texas driver framework.

For our insurance price comparison, we chose to exclude carriers with less than 1,000 to prevent biased comparisons. Internally, we use this data set and others to match the best insurance providers to their needs.

Our database is always processed and displayed immediately. The numbers specified in this article may differ from the latest data in the chart above.

Cheap Car Insurance For 19 Year Olds

Coverage Cat found that the progressive had the lowest premiums for young TX drivers in the $20-$30 age bracket at about $108 per month. For young drivers, especially those under the age of 25, insurance rates may be higher due to the higher risk of accidents. The average Texan between the ages of 20 and 30 pays $248 per month for auto insurance ($2,976/year), and purchasing a cheaper Progressive policy can save you as much as $1,680/year.

Insurers found that Progressive had the lowest rates for TX drivers between the ages of $60 and $70, at about $75 per month. Although auto insurance rates tend to drop after age 30, they can start to rise again for older drivers due to higher risk factors. In Texas, however, we found that the average Texan between the ages of 60 and 70 pays $105 a month for auto insurance. The range for these rates is wide, however, and the cheapest policy saves the average Texan between the ages of 60 and 70 $1,788/year compared to the most expensive policy.

For new cars, Coverage Cat found Clearcover and Progressive to have the best and cheapest auto insurance at about $151 a month. New cars cost more than older cars to insure because the cost of repairing or replacing these cars is higher than older cars. The cheapest auto carrier for new drivers in Texas costs about $3,276/year, which means Progressive and Clearcover customers can save $1,464/year in free premiums.

Coverage Cat found that for older cars, Clearcover & Progressive has the best cheap auto insurance, costing about $124/month for a 5-year-old car and $80/month for a 10-year-old car. As cars deteriorate, insurance companies pay less to repair or replace them, so it’s important to assess your insurance needs, including whether to buy comprehensive or contract insurance.

Cut Costs, Not Coverage. Save On Conroe Car Insurance With Tgs Insurance Agency

For female drivers in Texas, the lowest average salary is at Progressive for $94/month. Coverage Cat found that female drivers in Texas are paid slightly more than male drivers, with an average salary of $118/month. While that’s only $1 more per month (or $12/year) than male drivers in TX, for some carriers the difference is $288/year.

For Texas drivers, the best auto insurance rates are available at Progressive for $94/month. The average price for male drivers is slightly higher at $117/month, but the most expensive carrier (Allstate) costs $1,644 more per year than Progressive.

Tip: You may also want car insurance if you rent or lease a car regularly, as it can be cheaper and offer more protection to get a non-owner policy that will cover your bills.

If you don’t have a clean driving record, your insurance rates will be higher than those suggested here, regardless of the type of insurance you choose. Expect a 20-25% increase in speeding and distracted driving violations; 25-30% increase for open spaces, speed, causing accidents; and 50-70% increase for driving without a license, DUI or speeding.

Aarp Car Insurance From The Hartford

If it’s been more than three years since you lost your good driver, it’s time to shop around for new car insurance.

A: Texas auto insurance is more expensive than the national average. The National Association of Insurance Commissioners (NAIC) estimates that drivers in Texas pay 14 percent more than drivers nationwide. The NAIC 2019 Auto Insurance Database Report estimates the average monthly premium for auto insurance is $100 in the U.S. and $114 in Texas.

A: According to Coverage Cat, Acuity has the cheapest auto insurance in Texas at about $36/month, which is less than the average price of $87/month. However, depending on your insurance needs, your insurance may be cheaper (and better) with another company.

A: Although the insurer has found that premiums are lower for Acuity drivers overall, switching to one company does not guarantee protection. We recommend that you shop for insurance at least every two years, get multiple quotes, and regularly review your insurance needs.

Quote Auto Insurance, Homeowners & Business Rates In Texas

If that’s too complicated, try a cover. We optimize your coverage to best meet your needs