Student Loans Included In Bankruptcy – Yes. If you qualify, you may be able to discharge certain federal student loans through Chapter 7 or Chapter 13 bankruptcy. After you file a bankruptcy case, the other party must take additional steps to begin the process to cancel your loan. From November 2022, the process has been streamlined and streamlined in line with Ministry of Justice guidelines. Now, most filers with federal student loan debt can do so on their own without hiring an attorney. To qualify under the new guidelines, your loan must be a federal direct loan or a direct consolidation loan administered by the Department of Education. Additionally, you must be able to show that you have been unable to make payments but have made them in good faith in recent years.

It’s a long-standing myth that you can’t get rid of your student loans through bankruptcy. This myth persists in part because the majority of student loan borrowers who qualify for debt discharge in a bankruptcy case don’t even try.

Student Loans Included In Bankruptcy

:max_bytes(150000):strip_icc()/when-declare-bankruptcy.asp_final-dee86ed091424fbead478b44f98860b2.png?strip=all)

The bankruptcy process itself requires many forms, documents, and patience. And you’ll need to take extra steps to pay off your student loan debt. This means filing a lawsuit against the other party. In the past, many people feared that the process was too complicated and required a separate hearing, so most filers decided to hire an attorney.

Biden Administration Offers New Path To Discharging Student Debt In Bankruptcy

In November 2022, the Department of Justice and Education released new guidelines aimed at making the process of dealing with adversaries simpler and less intimidating. The guidance also provides clarity to courts as to how filers can demonstrate “undue hardship.” We are still waiting to see what impact the new guidelines will have, but there is early evidence that it may make it easier to obtain a bankruptcy discharge for federal student loan debt.

If you meet the eligibility requirements, bankruptcy may be a viable way to discharge some or all of your student loan debt. First, determine if you are eligible to file a personal bankruptcy case. This could be Chapter 7 or Chapter 13, depending on your financial situation and goals. Then see if your loan qualifies. Finally, make sure you meet the excess need criteria for student loan repayment through bankruptcy.

If you’re considering filing for bankruptcy to get a fresh start, start by considering your entire financial situation, including the types of debt you currently have, how much debt you have, and your current income and expenses. You’ll also want to consider whether you own assets, such as cars, homes, or retirement accounts, and whether bankruptcy is the best form of debt relief for you.

A means test requires knowing your income and expenses. This is a test that all Chapter 7 bankruptcy filers must pass to prove they are eligible to file bankruptcy. You can still file for bankruptcy if you don’t pass the means test, but you may need to look into Chapter 13. You can use our app to see if you are eligible to file for Chapter 13 using the nonprofit’s free screening program. 7 Bankruptcy Documents.

Can You File For Bankruptcy On Private Student Loans? Pros And Cons

You’ll also want to look into what types of loans are available. Currently only U.S.-held Federal Direct Loans and/or Direct Consolidation Loans are available. that. The Department of Education may be eligible for bankruptcy discharge under new guidelines. If you’re not sure what type of loan you have, you can get that information from the National Student Loan Data System (NSLDS). NSLDS stores information about federal student aid you have received.

Perkins loans, FFEL/FFELP loans, and private student loans are not included in the new guidelines. In some cases, you can file bankruptcy for these loans and private student loans, but the process looks different. For more information, see Can Private Student Loans Be Forgiven in Bankruptcy? Please read the article.

These three elements make up what is often called the Brunner test. Bankruptcy law does not clearly define how a claimant can prove that he or she is unable to pay or has made a good faith effort to pay. The new DOJ guidance helps bankruptcy judges interpret bankruptcy law more uniformly by defining the elements of the Brunner test. You can learn more about each item in the Attestation Forms section below.

If you desperately need to repay your student loans and are considering filing bankruptcy to resolve your loans and other debts, you can take a free examination to see if you qualify to prepare your documents for free. It only takes 5 minutes to see if you qualify.

Student Loan Debt Relief

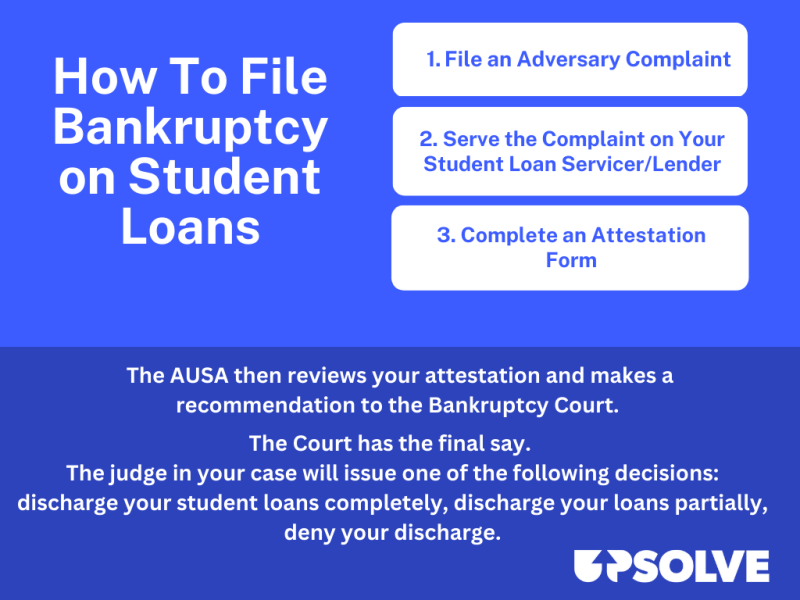

Let’s take a look at the steps to getting your student loans discharged in bankruptcy. For the sake of brevity, we will assume that you are already familiar with how to file a bankruptcy case. If not, read our popular article How to File Bankruptcy for Free first.

The other party’s complaint starts the other party’s proceedings. This is very similar to a civil lawsuit. You begin your case against the other party by filing a complaint with the clerk of the court. A complaint is a formal legal document.

Depending on your location, you may also be able to file electronically. If you are not submitting electronically, you must submit with a personal statement, which is available in PDF format on the site. If you are eligible to file a case with , our non-profit organization can help you file your complaint.

You should include a complete list of your student loans along with the other party’s complaint. To get this list, you can download a report from the National Student Loan Data System (NSLDS). Here’s an article that details how to do this: How to Use the National Student Loan Data System (NSLDS).

Can You File Bankruptcy On Private Student Loans?

American assistant it. The United States is represented by the Attorney General (AUSA). that. The Ministry of Education is in progress. AUSA will review the adversary’s complaint and your attestation form.

After you file your complaint with the court, you must “serve” the complaint on the defendant you named (the federal student loan servicer) and send copies to specific parties in your bankruptcy case.

Serving a complaint simply means mailing or hand-delivering a copy. The point is to inform the defendant (your lender) of the other party’s proceedings. You must also serve the subpoena and complaint on AUSA.

If you do not hear from us within two weeks of sending your US documents, we recommend that you follow up with that office.

Student Loans And Bankruptcy

The Department of Justice has an online search tool to help you find the contact information you need.

Call the office and tell them you want to make sure they have received the other party’s bankruptcy filing. Once you receive confirmation, contact the office about next steps. The Department of Education must send a report of the lawsuit to the U.S. Department of Education. that. chambers. Ask them to provide you with a copy of the report.

Some offices move faster than others. Don’t be afraid to follow up regularly on the progress of your case.

Next, you will fill out an attestation form to be sent to the United States. that. An attorney in your local bankruptcy filing district. This is the form used to determine if you meet the hardship requirements. The form begins with basic questions to collect your personal information and information about your student loans. The remainder of the form is devoted to understanding whether you meet the excess needs criteria by asking questions about your income and expenses.

Turns Out Bankruptcy Can Wipe Out Student Loan Debt After All

Cost Information: Includes basic living expenses, uninsured medical expenses, payroll deductions, housing, transportation, child care, and other necessary expenses.

What you’ll need to answer these questions: It’s helpful to gather recent wages, bank statements, and unemployment or Social Security documentation (if applicable) to help you complete the income portion of the form. For these expenses, collect recent bills, including medical bills, insurance premiums, pay stubs (to check deductibles), and recent transportation bills and receipts (including maintenance and gas bills).

If you use a credit or debit card to pay for your expenses, you can look at your recent transactions to identify some expenses for which you can’t keep receipts, such as groceries, household items, clothing, personal care items, and gas. . Car or public transportation costs. Also include cost information for dependents.

There is a very simple formula to determine your ability (or inability) to repay your monthly student loans. Total income minus allowable expenses. You will pay your gross income and allowable expenses on the certification form. If you crunch the numbers through a formula and it shows you have $0 left each month, that means you don’t have the ability to repay your student loan debt.

Student Loans: Biden Administration Makes It Easier To Discharge Debt In Bankruptcy

If you have income, AUSA will review your loan payments to determine if you qualify for partial forgiveness.

The attestation form asks you a series of questions to determine the following: